Stock prices may also move more quickly in this environment. Participation from Market Makers and ECNs is strictly voluntary and as a result, these sessions may offer less liquidity and inferior prices. ET) and the After Hours Market (4:00-8:00 p.m. Investors may trade in the Pre-Market (4:00-9:30 a.m. This data feed is available via Nasdaq Data Link APIs to learn more about subscribing, visit Nasdaq Data Link's products page. Real-time bid and ask information is powered by Nasdaq Basic, a premier market data solution. You can use the bid-ask spread to determine whether to place a market order or limit order when trading, helping you to optimize your price and have a successful order execution. In contrast, a larger spread suggests lower liquidity, as there are fewer investors willing to negotiate. Often, a smaller spread suggests higher liquidity, meaning more buyers and sellers in the market are willing to negotiate. The bid-ask spread can indicate a stock’s liquidity, which is how easy it is to buy and sell in the marketplace. The data displayed in the quote bar updates every 3 seconds allowing you to monitor prices in real-time. The bid size displays the total amount of desired shares to buy at that price, and the ask size is the number of shares offered for sale at that price.

The numbers next to the bid/ask are the “ size”. amount that a seller is currently willing to sell. The bid is the highest amount that a buyer is currently willing to pay, whereas the ask is the lowest Plug Power’s gigafactory is located in Rochester, New York, and it reportedly produced 122 megawatts of “electrolyzer stacks for customers and Plug’s green hydrogen plants.” Moreover, prepare for a major scale-up as Plug Power is “on track” to ramp the gigafactory’s capacity up to 100 megawatts per month in the middle of the current quarter, “with plans to further increase output” during the third quarter of this year.The bid & ask refers to the price that an investor is willing to buy or sell a stock. This gigafactory features over 2 gigawatts of electrolyzers, 60,000 fuel cell stacks and 2.5 gigawatts of output capacity. I’m referring to Plug Power’s gigafactory, where on-site green hydrogen production takes place on a massive scale. Now, it’s time to ask yourself a tough question: Are you willing to overlook Plug Power’s current financial issues? If so, then I invite you to consider the piece of the puzzle that will drive Plug Power’s growth through 2030. Gigafactory Is the Key to Plug Power’s Future Growth In addition, Plug Power reported a widening net earnings loss during that time frame.

:max_bytes(150000):strip_icc()/ld9Sju6C-b97ab5bf1c494565b5a2bbe6becbce1e.png)

It’s also problematic that Plug Power’s cash and cash equivalents dwindled from $2.48 billion at the end of 2021 to $690.63 million at the end of 2022. On the other hand, Plug Power has a track record of quarterly EPS misses.

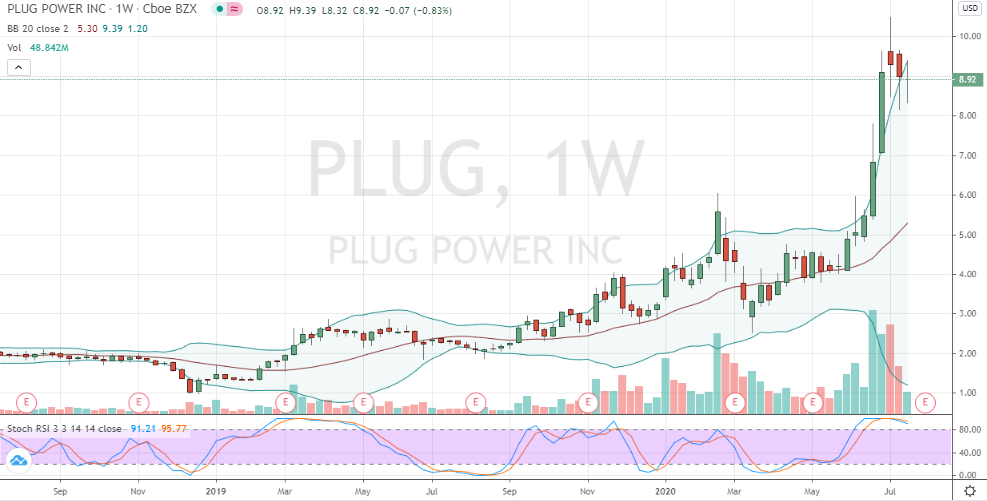

Plus, the average price target for PLUG stock is $25.50, which indicates strong upside potential. Out of 21 analysts, 16 gave Plug Power a “buy” rating and no “sell” ratings were observed. Indeed, Plug Power’s well-heeled investors include famous names like Vanguard and BlackRock (NYSE: BLK).įurthermore, Wall Street’s experts generally favor Plug Power. Still, the current Plug Power share price of around $10 seems too cheap, so there’s an opportunity here.Įven though many financial traders gave up on Plug Power, Samuel O’Brient reported that some big-money investors are staying in the trade.

I’ll be the first to admit that $60 was too high, too soon. PLUG stock peaked at around $30 last year and, prior to that, traded above $60 per share. PLUG Stock Investors Will Have to Forgive Poor Financials

0 kommentar(er)

0 kommentar(er)